21+ mortgage points cost

Get your personalized rates. One point costs 1 of your mortgage loan amount.

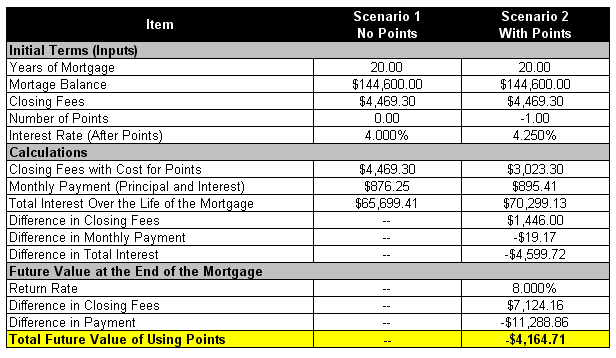

Which Is Better Points Or No Points On Your Mortgage

For example if your mortgage is 300000 and your interest rate is 35 one point costs 3000 and lowers your monthly interest to 325.

. If you are borrowing 325000 then youll spend 3250 for one point or 6500 for two. Loan origination fees aka. Web Points cost 1 of the balance of the loan.

These points are often included in the cost of originating your loan. And so on To. Web So if you have a 250000 mortgage the cost of one point is 2500.

Because each point reduces your interest rate by 025 youll need to buy four points to reduce your rate by a full percent. One point on a 300000 mortgage loan would cost 3000. Web If youre looking to obtain a 30-year 400000 mortgage with an interest rate of 5 and your lender charges you four points to reduce your interest rate by 1 you would first calculate the cost of the points.

Web A mortgage point equals 1 percent of your total loan amount for example on a 100000 loan one point would be 1000. For example if your mortgage is 300000 and your interest rate is 35 percent one point costs 3000 and lowers your monthly interest to 325 percent. Web The cost for each mortgage point depends entirely on your loan amount in other words the larger your home loan is the more youll need to pay for each one.

They dont affect the interest rate on your loan but do allow you to compare costs among mortgage lenders while youre shopping around. In effect mortgage points are a type of prepaid interest. Web Mortgage points arent free.

There is no application fee to apply for a mortgage. For example if youre borrowing 100000 1 of that one point equals 1000. Web Each mortgage discount point usually costs 1 of your total loan amount and lowers the interest rate on your monthly payments by 025.

For example if you take out a mortgage for 100000 one point will cost you 1000. Web Mortgage Points Calculator Calculate your payment and more Buying mortgage points when you close can reduce the interest rate which in turn reduces the monthly payment. You will need to keep the house for 72 months or six years to break even on the point.

Web Mortgage interest paid when cost was settled. Because each point lowers the interest rate by 025 buying one point lowers your mortgage interest rate from 3 to 275. On a 600000 loan 1 mortgage point costs 6000.

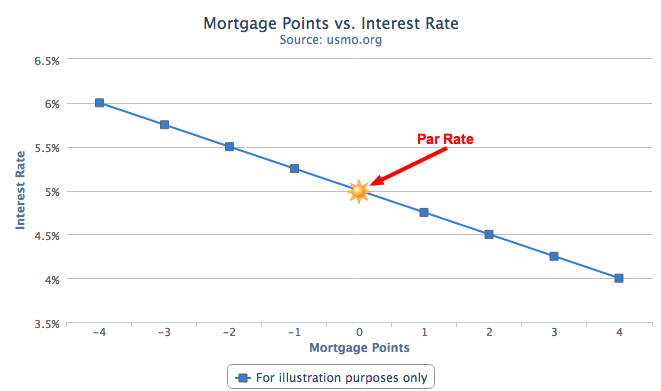

Each lender is unique in terms of how much of a discount the points buy but typically the following are fairly common across the industry. One point equals one percent of the principal mortgage amount so on a 250000 loan one point would cost 2500. Web Mortgage points are an additional upfront cost when you close on your loan but theyre also a way for borrowers to negotiate a lower interest rate on their mortgage.

Web A mortgage point is equal to 1 percent of your total loan amount. So one point on a 300000 mortgage would cost 3000. On a 200000 loan 1 mortgage point costs 2000.

If your interest rate was at 65 buying a discount point would lower your interest rate to 625. Discount points are upfront fees a borrower pays a lender in order to get a reduced interest rate. Web Say you buy one point on a mortgage loan of 300000 which costs 3000 1 of the loan amount.

Web Mortgage points aka. Another way to think of it is that one point equals 1000 for every 100000 of the loan amount being borrowed. These would be written as a percentage of the borrowed money.

Real estate taxes that were paid for by the mortgage lender. Buying points to lower your monthly mortgage payments may make sense if you select a fixed-rate mortgage and plan on owning the home after reaching the break-even period. Additionally you may have costs associated with a home inspection and appraisal both performed by third parties.

Web Each mortgage discount point usually costs one percent of your total loan amount and lowers the interest rate on your monthly payments by 025 percent. If a borrower buys 2 points on a 200000 home loan then the cost of points will be 2 of 200000 or 4000. Web Each mortgage point you buy lowers your interest rate by 025.

Web A mortgage point sometimes called a discount point is a fee you pay to lower your interest rate on your home purchase or refinance. These fees are calculated as estimated closing costs and are provided to. Web Each point the borrower buys costs 1 percent of the mortgage amount.

There are wide variations in the amount of rate discount you can buy with the point but its generally between 0125 and 025. Mortgage points are essentially a form of prepaid interest you can choose to pay up front in exchange for a lower interest rate and monthly payments a practice known as buying down your interest rate. With this example if you bought two points youd pay 6000 when your mortgage closes.

For example on a 100000 loan one point would be 1000. The initial interest rate was 3. Since each point costs 1 of the purchase price the total cost would be 16000.

Web One mortgage point typically costs 1 of your loan total for example 3000 on a 300000 mortgage. Web As the cost of a point is based on a percentage point of your mortgage the larger the mortgage the more it costs to buy a point. Web Closing costs typically represent 2 to 4 of the homes purchase price and vary by state.

The interest you paid at the time of the home purchase. Web Each point you buy costs 1 percent of your total loan amount. Web Purchasing the three discount points would cost you 3000 in exchange for a savings of 39 per month.

So if youre taking out a 300000 home loan with a 10 down payment making your loan amount 270000 each point would cost you 2700. Web As mentioned above one mortgage point is equal to one percent of the loan amount. One point on a 400000 mortgage loan would cost 4000.

Web A single mortgage point or just a point is equal to 1 of the amount you borrow. Learn more about what mortgage points are and determine whether buying points is a good option for you. Variation exists among these costs and each house purchase carries.

By using discount points to lower your interest rate you effectively lower your overall monthly. One discount point costs 1 of your home loan amount.

:max_bytes(150000):strip_icc()/GettyImages-931812572-a67e660bd8c2476a9d7f87e76a97b158.jpg)

How Mortgage Points Work

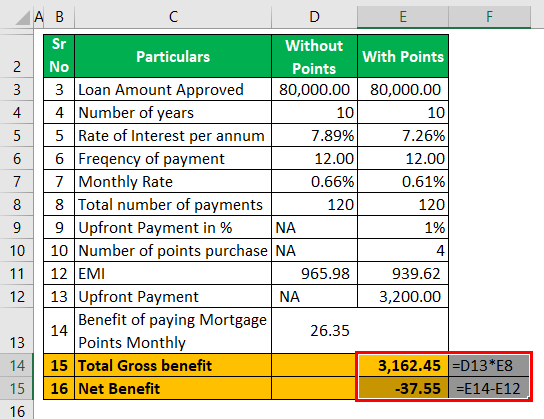

Discount Points Calculator How To Calculate Mortgage Points

Dp Times Vol 3 Issue 21 May 21 27 2010 By Dana Point Times Issuu

Mortgage Points Calculator Calculate Emi With Without Points

Mortgage Points Calculator Nerdwallet

Solved Local Lenders Are Offering The Following Terms For Chegg Com

Papers Past Parliamentary Papers Appendix To The Journals Of The House Of Representatives 1897 Session Ii Education Twentieth Annual Report Of The Minister

Understanding Mortgage Points U S Mortgage Calculator

Which Is Better Points Or No Points On Your Mortgage

Discount Points 866 569 8272 What Are Points On A Mortgage Youtube

Interest Rates Are Rising American Association Of Private Lenders

Vikings Favored By 7 5 Points In The Game Against The Lions

Bilt The First Ever Rewards Program To Earn Points On Rent Is Reinventing Itself The Points Guy The Points Guy

Mortgage Discount Points Calculator Mortgage Calculator

What Are Mortgage Points And How Do They Work

How Mortgage Points Work

Shryne Group Stiiizy Receives Senior Secured Term Loan That Could Go Up To 170m