Vehicle depreciation calculator taxes

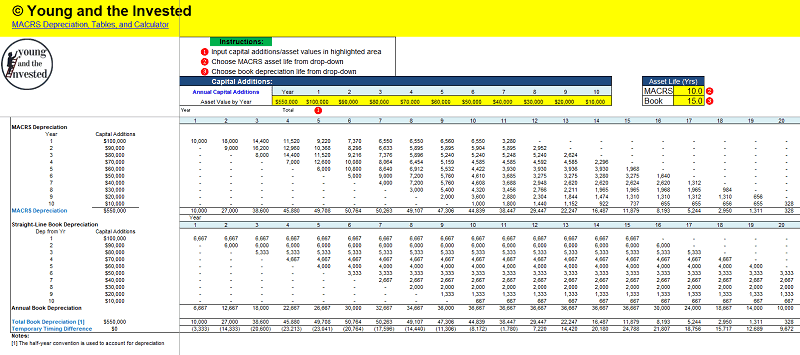

The MACRS depreciation calculator adheres to US income tax code as found in IRS Publication 946 opens in new tab. Depreciation can affect the value of your assets and your taxes often for several years.

Car Depreciation Calculator

Use our depreciation calculator to estimate the depreciation of a vehicle at any point of its lifetime.

.png)

. NW IR-6526 Washington DC 20224. Tangible personal property as defined by state code is all personal property not otherwise classified as intangible personal property merchants capital or as short-term rental property Code of Virginia 581-3500In general tangible personal property is a moveable item that is real material substantive and not permanently affixed to. Failure to do so can result in penalties andor void warranties.

It is determined by using a formula based on the vehicle manufacturers suggested retail price MSRP or purchase price for commercial trucks and commercial trailer and a depreciation schedule set by state law based on the age of the. Select the payment mode from the various options listed such as debit card internet banking and more. Vyapar depreciation calculator- Simplest online depreciation calculator for assetProperty etc using the SLM DBM methods.

Experian 2020 Q1 data published on August 16 2020 Across the industry on average automotive dealers make more money selling loans at inflated rates than they make from selling cars. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. Edmunds True Cost to Own TCO takes depreciation.

Using depreciation expenses while filing taxes help you gain better control over your business finances. As a good rule of thumb repairs tend to run close to 100 or so per month on average though it can vary significantly based on the vehicles age and. We base our estimate on the first 3 year depreciation curve age of vehicle at purchase and annual mileage to calculate rates of depreciation at other points in time.

Most lease contracts will require the lessee to perform regular upkeep of the vehicle such as servicing it with proof on a regular basis. You can use a double-declining calculator. 2023 Nissan Altima gets upgraded everywhere but under the hood.

10 1 2 years 15 2 3 years 20. The downside of buying a vehicle is mainly depreciation where the value of the vehicle drops almost as soon as its driven it off the dealership floor. The RTA tax is a motor vehicle excise tax MVET calculated from the depreciated value of your vehicle.

Loan interest taxes fees fuel maintenance and repairs into. Above is the best source of help for the tax code. Credit card calculators.

The first-year limit on depreciation special depreciation allowance and section 179 deduction for vehicles acquired after September 27 2017 and placed in service during 2021 increases to 18200. To help you see current market conditions and find a local lender current Redmond auto loan rates are published in a table below the calculator. However if you have claimed vehicle depreciation you may not deduct tolls and parking feesCars used by employees for business use the portion of.

The best way to calculate depreciation for a vehicle is by using a unit of production method. Kenya Motor Vehicle Duty Calculator 2022. Enter your motor vehicle details below to get a duty estimate based on Kenya Revenue Authority KRA.

Decide Which Auto Loan is Best for You Use this calculator to compare two auto loans by filling in their specifics and. Additional Vehicle Use Deductions. The second calculator helps you figure out what vehicle price you can afford for a given monthly loan payment.

Credit cards. The Corporate Average Fuel Economy CAFE standards are regulations in the United States first enacted by the United States Congress in 1975 after the 197374 Arab Oil Embargo to improve the average fuel economy of cars and light trucks trucks vans and sport utility vehicles produced for sale in the United States. Useful life describes the amount of time it takes for your vehicle to lose 100 of its original value.

You will probably agree that selling it for 20000 again would not be especially fair you have some sort of a gut feeling that it is worth much less now. The first calculator figures monthly automotive loan payments. Calculate the cost of owning a car new or used vehicle over the next 5 years.

While this calculator allows people to estimate the cost of interest and depreciation other costs of vehicle ownership like licensing fueling repairs automotive insurance are not included. MACRS Depreciation Calculator Help. If you have a question about the calculator and what it does or does not support feel free to ask it in the comment section on this page.

In the simplest terms depreciation is the decrease in valueImagine that you bought a car for 20000. 0 - 6 months. In addition to the standard mileage rates you may deduct the costs of tolls and parking while using your vehicle for one of the approved purposes - these are separate deductions.

Debt Consolidation Calculator How much can you. Use a vehicles registration number to login to the portal. Credit Card Calculator Calculate the total cost of a credit card based upon the balance and the minimum payment made.

Credit Card Comparison Calculator Use Our Credit Card Comparison Calculator To Calculate Total Costs and Rate Changes with up to 3 Credit Cards. It mustnt exceed 6000 pounds in unloaded gross weight. Before you sign a loan agreement with a dealership you should contact a community credit union or bank and see how they compare.

We welcome your comments about this publication and your suggestions for future editions. The IRS defines a car as any four-wheeled vehicleincluding a truck or vanintended for use on public streets roads and highways. Find the option marked Online Service and select Vehicle Related Services Step 4.

While we have tried our best to provide you with an accurate estimate on the taxes payable we however. Lessees with too much excessive wear and tear have the option to avoid penalties if they buy the vehicle at the end of the lease. After a few years the vehicle is not what it used to be in the beginning.

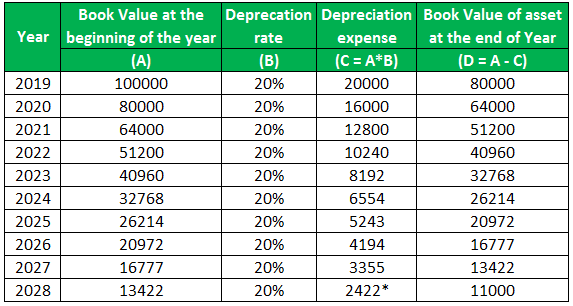

Use this calculator to see if paying for you next car truck or SUV in cash is better than financing the vehicle with a low interest loan. The general idea behind car depreciation for taxes is to spread the cost of a car out over its useful life instead of writing off its whole cost the year you buy it. The book value is the assets cost minus the.

You will pay Ksh 160800 on top of KRA duties and taxes as follows. In addition you have the hassle of selling the vehicle when you want a new one and youre responsible for the maintenance and insurance. Car Depreciation Calculator.

You may qualify to deduct some of your vehicle-related expenses if you use your car for business purposes. Business Tangible Property and Vehicles. And lets not forget FOMO fear of missing out.

DEPRECIATION FOR DIRECT IMPORTS. What auto depreciation means for your taxes. CAFE neither directly offers incentives for customers to.

While we have tried our best to provide you with an accurate estimate on the taxes payable we however recommend you contact a clearing agent to assist you in confirming the taxes payable for importing the car of your choice. If you elect not to claim a special depreciation allowance for a vehicle placed in service in 2021 the amount increases to 10200.

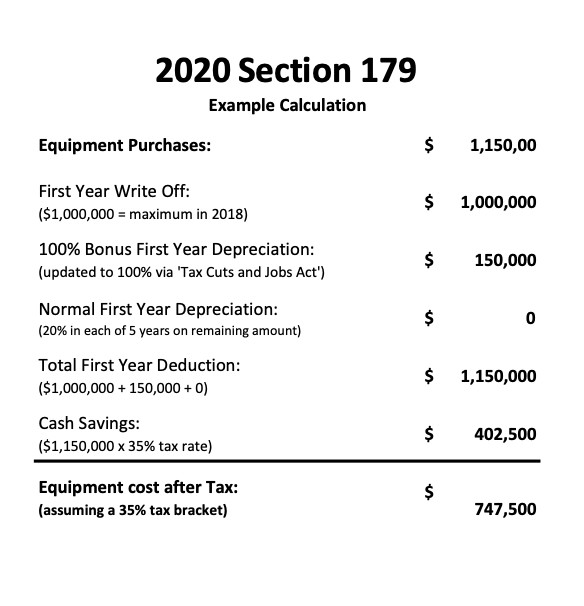

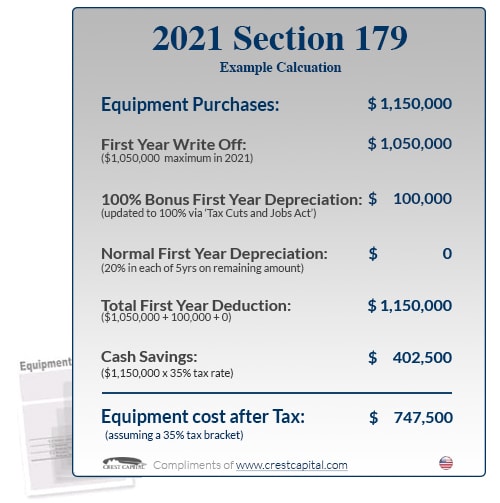

2020 Section 179 Commercial Vehicle Tax Deduction

Section 179 Tax Deduction Vehicles List Bell Ford

Car Depreciation Rate And Idv Calculator Mintwise

Depreciation Rate Formula Examples How To Calculate

/4562-0ccce5dc10454fcea87824d93ca6da97.jpg)

Form 4562 Depreciation And Amortization Definition

Download Depreciation Calculator Excel Template Exceldatapro

Macrs Depreciation Table Calculator The Complete Guide

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

Macrs Depreciation Calculator Straight Line Double Declining

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

Macrs Depreciation Calculator Irs Publication 946

.png)

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

Free Macrs Depreciation Calculator For Excel

Depreciation Calculator Depreciation Of An Asset Car Property

Depreciation Rate Formula Examples How To Calculate

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos